Goldman Sachs Earnings Coming Soon: Wall Street Expectations Divide Deeply

Goldman Sachs(337.565, 10.37, 3.17%) will release its second-quarter financial report on Wednesday local time, and Bank of America(30.7968, 1.40, 4.75%) industry analysts are seriously divided on the results, with forecasts diverging far more than normal circumstances.

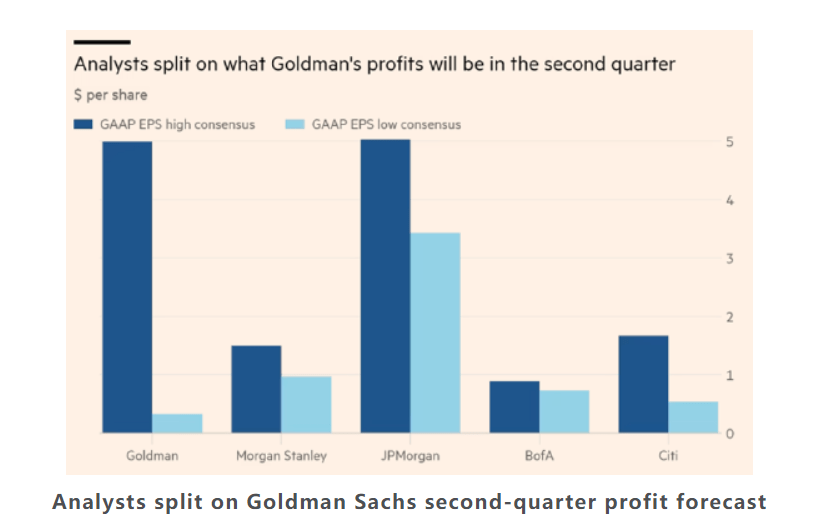

The consensus is that this won’t be Goldman’s “best ever” quarter, but the point is that some analysts think it could be its “worst ever.” Regarding Goldman Sachs’ earnings per share, the current market expectations are as low as $0.33 (barely realizing a profit) and as high as close to $5 (a net profit of more than $1.5 billion).

While it’s not uncommon for analysts to be divided, the market is more divided on what exactly Goldman Sachs will report on Wednesday under David Solomon.

The source of the uncertainty is that some analysts expect Goldman’s leadership to take a “kitchen sink” approach, adding as many one-off items as possible in an already challenging quarter.

“Goldman Sachs doesn’t want to be a ‘recidivist’. They don’t want to continue telling investors to write down more expenses next quarter. This is the basic homework of the CEO.” Wells Fargo (45.34, 0.60, 1.34(45.32, 0.58, 1.30%) said .

Like its peers, Goldman’s earnings were weighed down by a plunge in investment-banking fees and a drop in stock and bond trading. But beyond that, possible writedowns from recent acquisitions and losses on consumer and commercial real estate lending will hit its bottom line.

Analysts also predicted that Goldman Sachs’ net profit for the quarter could reach as high as $1.7 billion and as low as $116 million, a drop far exceeding that of its peers.

In terms of earnings per share, the market’s lowest expectation is 33 cents, and the highest expectation is $4.99. The gap also far exceeds that of other banks. At the same time, it also sets the largest gap between analysts’ performance expectations for Goldman Sachs in more than two years. On Wall Street, 10 cents a share is already far above expectations.

Analysts split on Goldman Sachs second-quarter profit forecastAnalysts split on Goldman Sachs second-quarter profit forecast

The unpredictability came even as Goldman’s management team tried harder than ever to explain to investors that the company would face challenges in the quarter.

Solomon said in an interview in June that Goldman would take “impairments” on the loans it made in commercial real estate, while President John Waldron warned that its equity and fixed-income trades would suffer year-over-year declines. 25% drop.

Analysts also expect Goldman to take hundreds of millions of dollars in writedowns on GreenSky, its renovation lending business. It’s a business the company bought last year for $2.2 billion but is currently up for sale.

(91.84, 5.47, 6.33%)(153.96, 0.58, 0.38%)153.94 , 0.56 , 0.37% )

This will increase the challenge facing Solomon. He has been CEO of Goldman Sachs since 2018 and is already under pressure to deal with employee unease and diversify the business.

While Salomon began expanding into new business areas, Goldman still relied heavily on traditional businesses such as investment banking and trading. And because of the volatility of these businesses, they cannot command high valuations in the stock market.

After years of losses, Goldman Sachs is scaling back its consumer banking ambitions and emphasizing growth plans in its asset and wealth management business. But analysts say those businesses are nowhere near on par with Goldman’s investment banking and trading operations.

Goldman’s return on equity, a key profitability metric, is expected to be around 5% for the quarter, below the 10% cost of capital threshold and below the firm’s own target of 14% to 16%.

Goldman Sachs has posted record profits amid turmoil in financial markets and continued investment banking activity amid the coronavirus pandemic. But some analysts worry the bank could face long-term poor returns, as it did during the 2008 financial crisis.

“The question for Goldman Sachs is: Are these challenges temporary and once they are resolved, they can achieve a ROE of around 15%?” said Autonomous Research analyst Christian Bolu. Bad time for extremely low returns?”